Bonham title loans provide a swift financial solution for San Antonio residents, offering quick cash access using vehicle titles as collateral. With faster application processes and online availability, these loans cater to those with credit challenges or urgent needs, but borrowers must be aware of higher interest rates and potential repossition risks. Understanding Bonham title loans empowers informed decision-making during unexpected expenses.

“Bonham title loans offer a unique financial solution for those in need of quick cash. In this comprehensive guide, we’ll demystify these loans, providing an in-depth look at how they work and the benefits they offer. From understanding the process and requirements to weighing the pros and cons, this article is your one-stop resource for everything related to Bonham title loans. Discover how this alternative financing option can provide relief during financial emergencies.”

- Understanding Bonham Title Loans: A Comprehensive Guide

- How Do Bonham Title Loans Work? Process and Requirements

- Benefits and Risks: Weighing Your Options with Bonham Title Loans

Understanding Bonham Title Loans: A Comprehensive Guide

Bonham Title Loans: Unlocking Financial Solutions

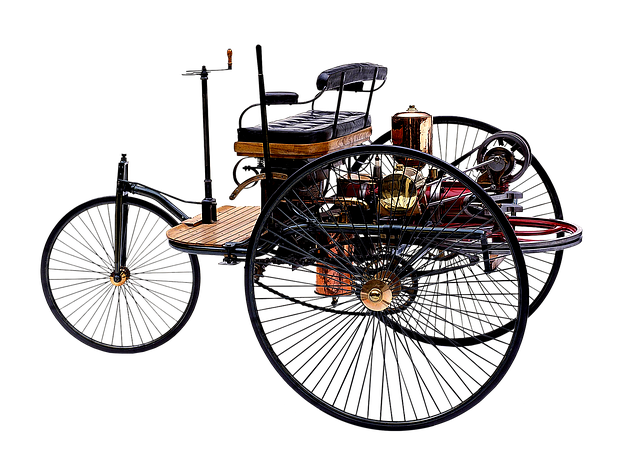

In the world of financial services, Bonham title loans offer a unique and accessible option for individuals seeking quick cash. These loans are secured by the title of your vehicle, making them an attractive alternative to traditional loan types. Whether you’re facing unexpected expenses or need funds for a specific purchase, understanding how Bonham title loans work is essential. This comprehensive guide aims to demystify the process and provide clarity on the benefits and considerations involved.

When it comes to securing a loan, bad credit need not be an obstacle. Unlike conventional loans that heavily rely on credit scores, Bonham title loans focus more on the value of your vehicle. Even if you have less-than-perfect credit or no credit history, owning a vehicle with a clear title can open doors to emergency funding. With a simple application process and fast turnaround times, these loans are designed to cater to the needs of San Antonio residents who require immediate financial assistance. Whether it’s for a truck title loan or any other purpose, understanding your options is key to making informed decisions regarding your finances.

How Do Bonham Title Loans Work? Process and Requirements

Bonham title loans offer a unique financing option for individuals seeking quick cash solutions. This process involves using the title of your vehicle as collateral to secure a loan. Here’s how it works: first, you initiate the application online or at a local Bonham title loan provider. You’ll need to provide essential documents, such as your driver’s license and vehicle registration, along with proof of income and residency. The lender will then assess your application and determine your vehicle’s value. If approved, you can receive fast cash within a short time frame.

The approval process for Bonham title loans is designed to be swift, ensuring you gain access to funds quickly. Lenders offer this convenience due to the secure nature of the transaction—the title acts as insurance for the loan. This means even if you default on the loan, the lender has legal recourse to repossess your vehicle. However, with timely payments, you can maintain possession of your asset and avoid such outcomes. Fort Worth loans, like any other secured loan, typically have higher interest rates but provide an excellent alternative for those in need of fast cash.

Benefits and Risks: Weighing Your Options with Bonham Title Loans

Bonham title loans offer a unique financial solution for individuals seeking quick access to capital. One of the primary benefits is their ability to provide funds with less stringent requirements compared to traditional loans. This alternative financing option allows borrowers to use their vehicle’s equity as collateral, which can be especially appealing to those with limited credit history or poor credit scores. By harnessing the value of an asset, Bonham title loans offer a way to gain immediate financial support without the rigorous application processes often associated with banks.

However, like any loan product, Bonham title loans come with risks. The primary concern is the potential for borrowers to default on payments, leading to repossession of their vehicles. Repayment options are crucial here; clear communication about the terms and conditions, including interest rates, repayment schedules, and any penalties for late payments, is essential. Additionally, individuals should be aware that secured loans, like Houston title loans, carry the risk of losing one’s asset if the loan is not repaid as agreed. Weighing these benefits and risks is vital before deciding on Bonham title loans to ensure an informed financial decision.

Bonham title loans offer a unique financing option, providing quick access to cash secured by your vehicle’s title. By understanding the process, benefits, and potential risks, you can make an informed decision. Whether it’s for an emergency or a planned expense, Bonham title loans can be a viable solution, but always weigh your options and consider the associated costs and implications before proceeding.