Bonham title loans provide swift financial solutions for individuals with vehicle equity, offering an alternative to traditional banking. The process involves assessing vehicle value as collateral, with approval granting quick access to funds. With streamlined application requirements and flexible repayment terms, these loans appeal to those with limited credit histories or high debts, facilitating debt consolidation. However, borrowers must research lenders to mitigate the risk of asset seizure upon default.

Looking for a flexible lending option in Bonham? Understanding your financial choices is crucial. This article delves into the world of Bonham title loans and compares them with traditional bank loan options. We’ll explore how these alternative financing paths work, their key benefits, and important considerations to help you make an informed decision based on your unique needs. Whether you opt for a Bonham title loan or a conventional bank loan, knowing your options empowers your financial future.

- Understanding Bonham Title Loans: An Overview

- Exploring Bank Loan Options: Traditional Lending Path

- Comparative Analysis: Benefits and Considerations

Understanding Bonham Title Loans: An Overview

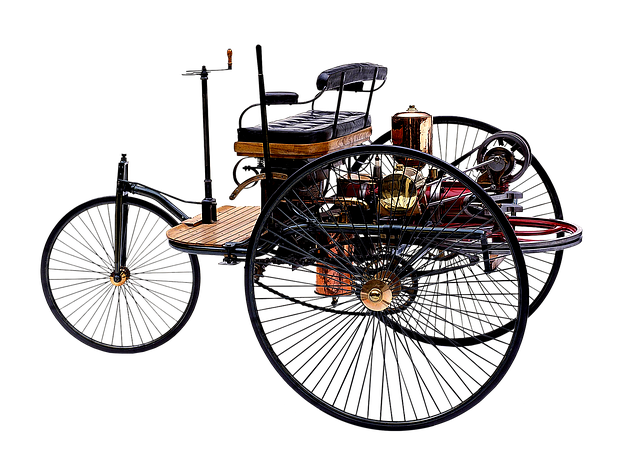

Bonham title loans offer a unique financial solution for individuals who own a vehicle and need quick access to cash. This type of loan allows borrowers to use their vehicle’s equity as collateral, providing a convenient alternative to traditional bank loans. The process involves assessing the value of the vehicle, including its make, model, age, and overall condition, to determine the maximum loan amount available. Once approved, borrowers can gain access to funds within a relatively short timeframe, making Bonham title loans an attractive option for those facing unexpected expenses or requiring emergency funding.

Unlike bank loans that often require extensive paperwork and strict credit checks, Bonham title loans streamline the application process. Borrowers typically need to provide proof of vehicle ownership, a valid driver’s license, and income documentation. The flexibility in repayment options is another advantage, as borrowers can choose terms that align with their financial capabilities. This allows them to focus on other aspects of their lives while comfortably making loan repayments over time, ultimately maintaining control over their vehicle ownership throughout the process.

Exploring Bank Loan Options: Traditional Lending Path

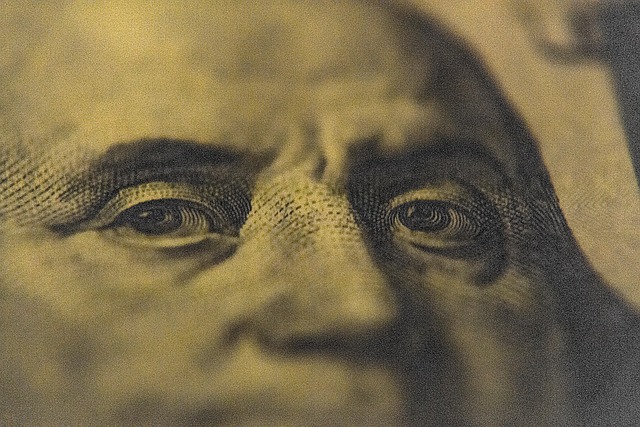

When considering your financial options, exploring bank loan alternatives like Bonham title loans can provide a unique and potentially beneficial path. This traditional lending route involves borrowing against an asset, such as a vehicle, which offers several advantages. For instance, it often requires no credit check, making it accessible to those with limited or less-than-perfect credit histories. This is in contrast to many bank loan options that rigorously adhere to strict credit scoring systems.

Moreover, Bonham title loans can serve various financial purposes, including debt consolidation. By combining multiple debts into a single, more manageable loan, individuals can simplify their repayment process and potentially save on interest charges. This can be especially attractive for those burdened by high-interest credit card debt or other costly borrowing arrangements.

Comparative Analysis: Benefits and Considerations

When comparing Bonham title loans to traditional bank loan options, several key factors stand out. Bonham title loans offer a unique advantage with their title transfer process, which allows individuals to borrow money using the value of their assets—such as vehicles—as collateral. This alternative financing method can be particularly beneficial for those who may not qualify for conventional loans due to poor credit scores or lack of financial history. With boat title loans, for instance, owners can access a line of credit secured by their vessel’s title, providing a flexible and accessible option for funding needs.

One significant consideration for Bonham title loans is the potential risk involved. Unlike bank loans that often come with stringent requirements and penalties for late payments, these loans are secured against an asset’s value. This means that if the borrower defaults, the lender has the right to seize and sell the collateral to recover their losses. However, proper research and understanding of the terms can help borrowers make informed decisions, ensuring they choose a reputable lender offering fair rates and conditions, even in the absence of a no credit check requirement.

When considering your financial options, it’s clear that Bonham title loans offer a unique and potentially beneficial alternative to traditional bank loans. By leveraging the value of your vehicle, these loans provide access to capital with faster processing times and less stringent requirements. However, it’s essential to weigh the benefits against potential drawbacks, such as interest rates and repayment terms, to make an informed decision that aligns with your individual financial needs and goals.